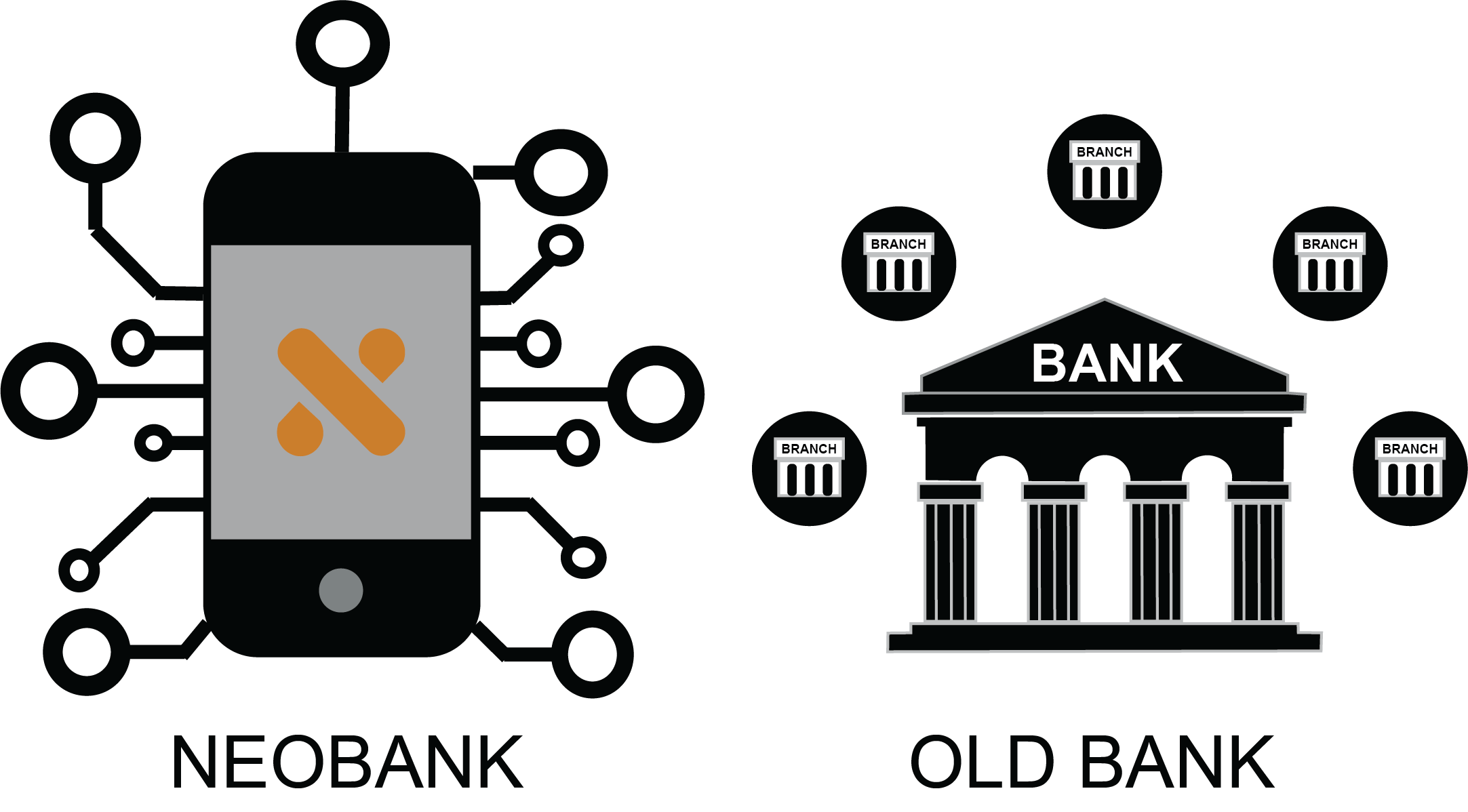

Neobanks (also known as digital-only banks) are FinTech companies that offer standard banking services entirely in digital format. They open accounts, issue payment cards, allow you to make payments and transfers, keep the balance of the card on the deposit.

The difference from ordinary banks is that neobanks do not have branches, and they work exclusively through a mobile application and / or a web platform.

With a wealth of experience in the financial industry and an increase in the staff of highly qualified employees, BMP Global decided to expand its scope of activities, develop and move towards FinTech.

BMP Global offers its clients the launching of their own turnkey digital-only bank in countries such as Canada and Great Britain.

Neobank licenses

We offer to obtain 3 kind of licenses: MSB License (Canada), SPI license (UK) and AEMI license (UK).

Our packages

1 |

2 |

3 |

License obtaining services |

Ready-made license services |

Turnkey project |

We would be glad to help you in launching your FinTech-project.

Our FinTech-projects

BMP Global took part in launching several FinTech projects, some of which were:

1. OTRY - digital-only bank with Canadian license

This project was created by the BMP Global team on a turnkey basis: the company took part in the project from creating a logo, obtaining a SWIFT / BIC code, integrating with correspondent banks to integration a banking software.

In addition, BMP Global is the majority shareholder of OTRY Capital.

2. PAYMIQ - digital-only bank with Canadian license

BMP Global team participated in several stages of obtaining MSB License for PAYMIQ, namely:

1. Company formation in Canada including physical address + local secretary

2. AML and KYC policies and procedures developing + business plan

3. Non-connected SWIFT and LEI numbers obtaining

4. MSB License obtaining

3. DSBC Financial Group - digital-only bank with Lithuanian license

In this project, the BMP Global team participated in several stages of launching a digital-only bank, namely:

1. Participation in negotiations with the regulator and the Central Bank of Lithuania

2. Building relationships with correspondent banks

3. Recruitment of qualified employees and finding an office in Vilnius

BMP Global will be glad to help you create your own digital-only bank, going through all stages from start to finish.

Our team is also ready to provide services for creating your IT product of any complexity.